About Me

Dr. Chang Xu is currently a Senior Researcher at the Machine Learning Group, Microsoft Research Asia (MSRA) . Her expertise lies in advancing fundamental machine learning and deep learning algorithms, including representation learning, network architecture design, and evolving learning paradigms (such as reinforcement, generative, contrastive, invariant, and causal learning). She has extensive experience in multi-modal learning across modalities such as sequential data, time series, text, and images. Her recent work also focuses on Large Language Models (LLMs), including foundation models, reasoning, and agentic systems, with a strong commitment to bridging the gap between theoretical innovations and real-world applications in finance, healthcare, and storage systems.

Prior to joining MSRA, Dr. Xu received her B.S. degree in Computer Science from Nankai University in 2014 and her Ph.D. in 2019 through the Joint PhD Program between Microsoft Research Asia and Nankai University. She has published dozens of papers in leading journals and conferences, including ICLR, ICML, NeurIPS, KDD, WWW, AAAI, IJCAI, EMNLP, MM, CIKM, ICME, IEEE TKDE, and IEEE TOC, with nearly 1,500 citations. She is an active member of the academic community, organizing workshops at top conferences and serving as a program committee member and reviewer for leading venues.

News

-

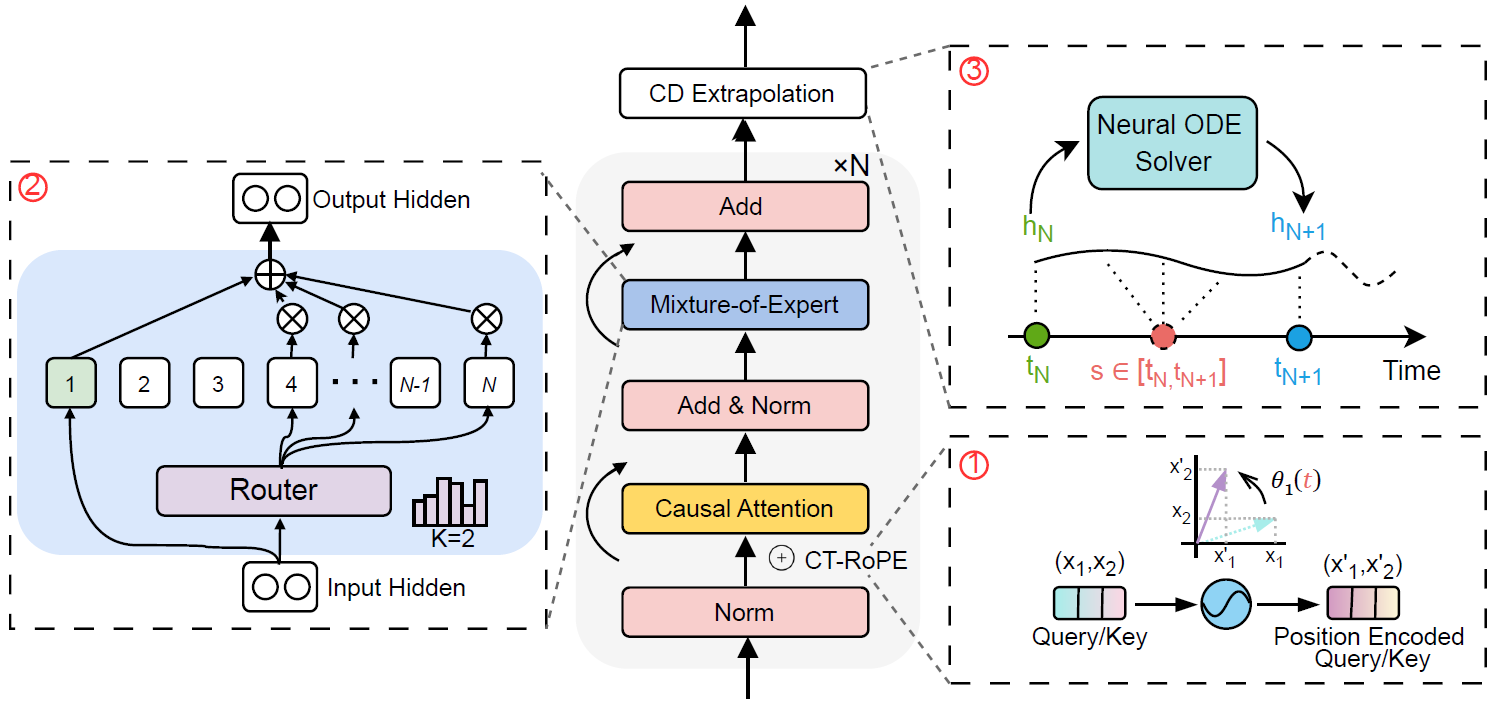

[Jan. 2026] We are releasing MIRA, a medical time-series foundation model designed for real-world healthcare data. MIRA is pretrained on over 454 billion time points and explicitly targets the core challenges of clinical time series, including irregular sampling, heterogeneous frequencies, and pervasive missing values.

Key technical highlights:

- Continuous-Time Positional Encoding (CT-RoPE): Encodes irregular time intervals directly in continuous time, enabling precise modeling of non-uniformly sampled clinical records.

- Frequency-Specialized Mixture-of-Experts: Routes signals with different temporal resolutions to specialized experts, improving representation learning across heterogeneous clinical variables.

- Neural ODE-based Continuous Dynamics Extrapolation: Models latent physiological dynamics in continuous time, enabling robust forecasting and natural handling of missing observations without interpolation.

- Large-Scale Pretraining for Zero-Shot Transfer: Pretrained on 454B+ time points, MIRA exhibits strong zero-shot and cross-dataset generalization across diverse clinical tasks.

-

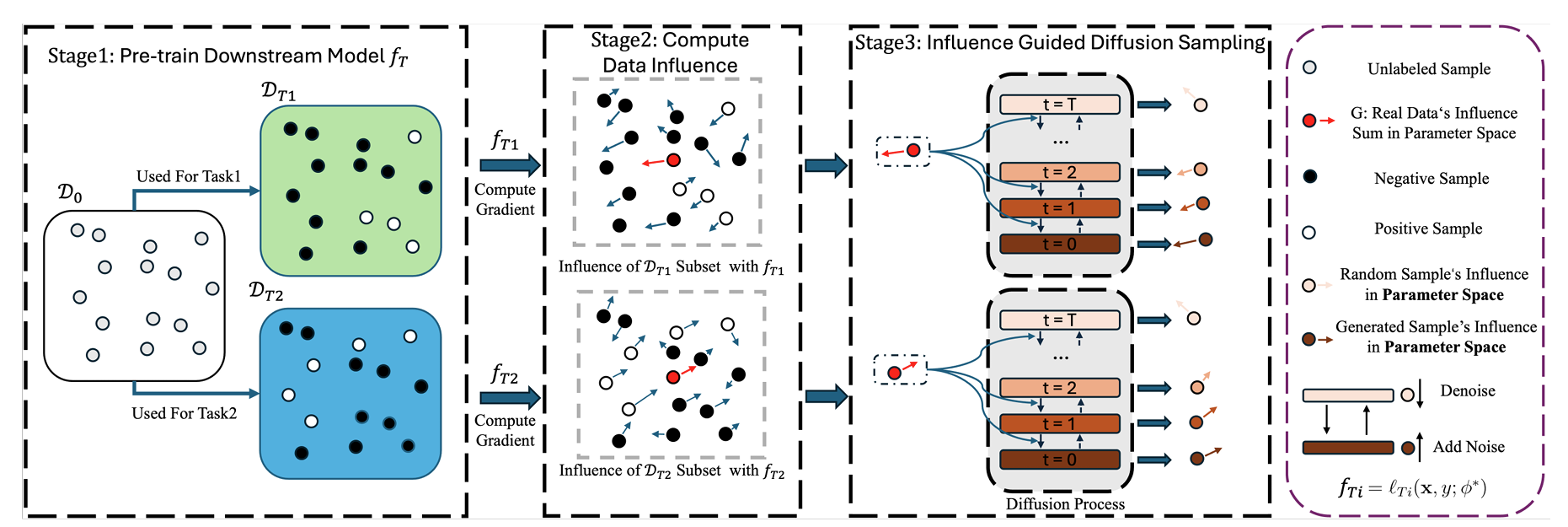

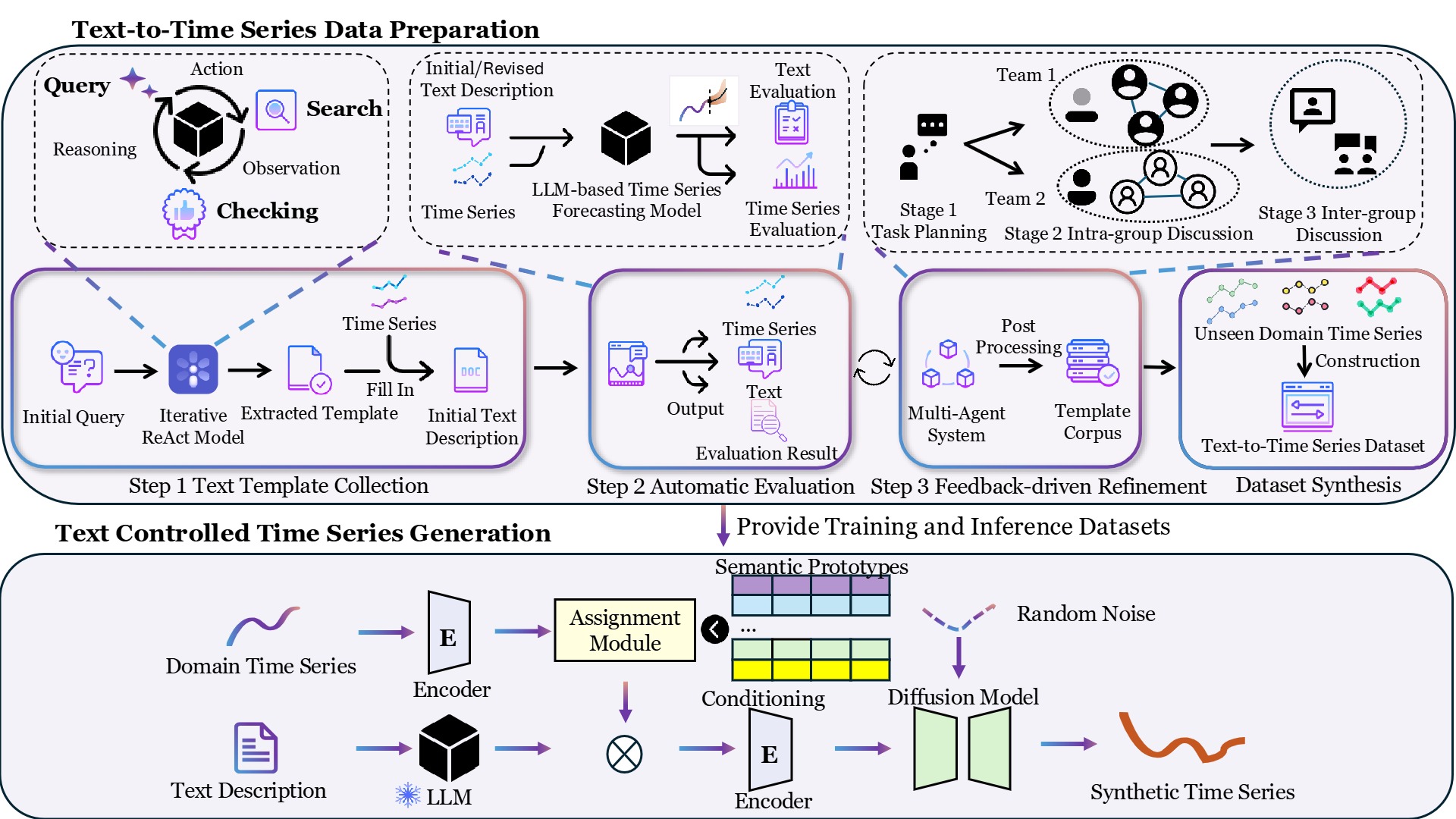

[May 2025] We are releasing TimeCraft, an innovative framework for synthetic time series generation!

TimeCraft introduces a novel approach by learning a universal latent space of semantic prototypes for time series, enabling impressive cross-domain generalization, while leveraging a diffusion-based framework to ensure high-fidelity and diverse data generation.

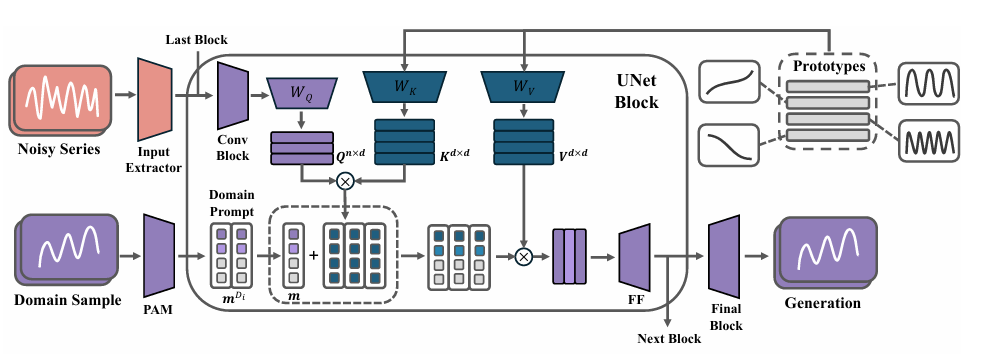

Key technical highlights:- Prototype Assignment Module (PAM): Adapts to new domains with few-shot examples.

- Text-based Control: Leverage natural language to guide the generation process.

- Influence-Guided Diffusion: Generates synthetic samples optimized for downstream task performance.

🔗 Explore the repository:

https://github.com/microsoft/MIRA

📄 量子位:

量子位链接

📄 知乎:

知乎链接

🔗 Explore the repository:

https://github.com/microsoft/TimeCraft

📄 中文宣传稿:

宣传稿链接

Intern Hiring

The MSRA Machine Learning Group is looking for research interns on Time Series Foundation Models, Generative Modeling & LLMs, and ML applications in Healthcare!- Interns will work on cutting-edge research with the goal of publishing in top-tier conferences/journals.

- Applicants should have a solid ML background, strong coding skills, and preferably prior research experience. Availability for at least 3 months onsite in Beijing is required.

- Please send your CV to chanx@microsoft.com with the subject line "Name + University + Grade" and include your available internship period in the email body.

Research Statement

Time-Series Analysis

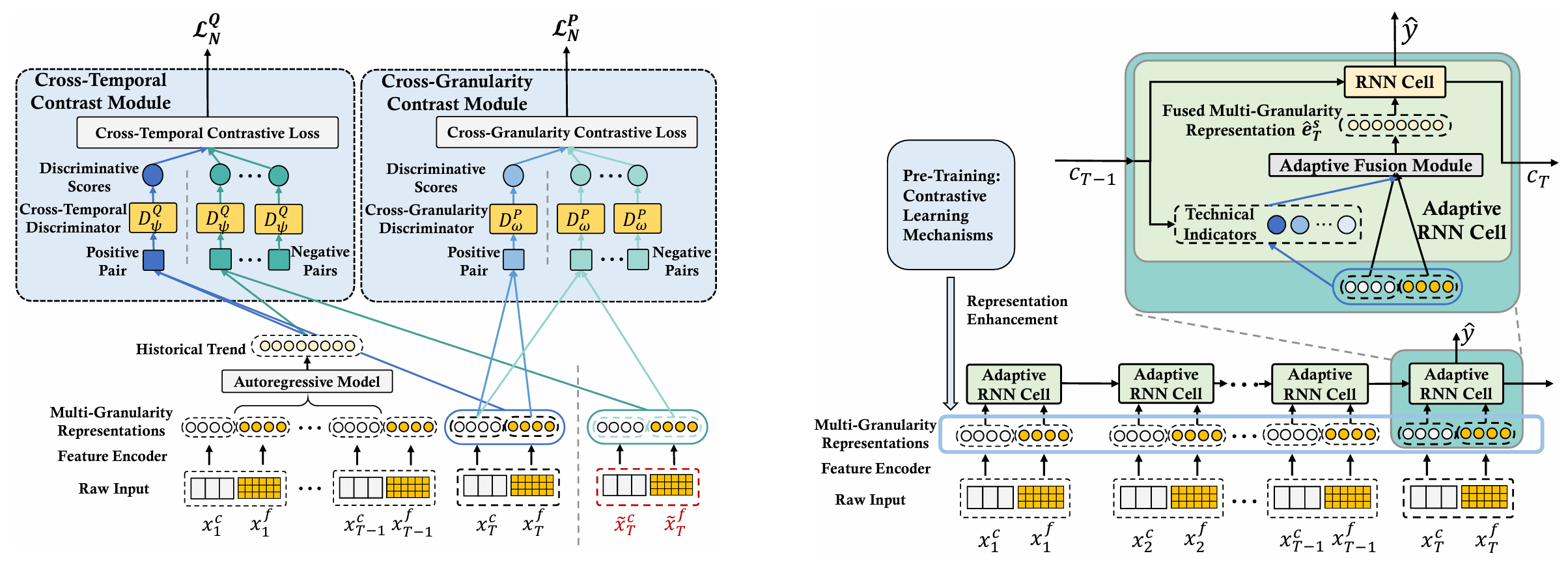

I investigate the integration of multiple levels of time-series data—both fine-grained (e.g., transaction-level or tick data) and coarse-grained (e.g., daily summaries or aggregated statistics). The challenge lies in effectively combining these different types of data to leverage their complementary strengths, and my work develops novel techniques to incorporate them into unified models, leading to improved performance and more robust predictions.

In addition to addressing granularity, I explore the power of cross-domain learning. Financial markets, healthcare, and other domains often share common underlying patterns, yet have domain-specific nuances. By capturing these general patterns and integrating relevant domain knowledge, I develop models that can transfer insights across domains. This approach enhances performance in data-scarce or noisy target domains and provides a way to apply learned knowledge from one area to another, creating more adaptable and versatile models.

Beyond traditional predictive modeling, I place significant emphasis on time-series generation. Generative models play a crucial role in simulations, data augmentation, and scenario testing. My research focuses on generating time-series data that is not only realistic but also controllable and interactive. This means developing methods to produce data that can be tailored to specific domains and even adjusted based on particular requirements—be it for risk evaluation, testing, or forecasting with specific constraints.

Finally, I emphasize interpretability in time-series models, ensuring transparency in how predictions are made, which is crucial for trust and application in high-stakes domains.

AI for Healthcare

I investigate how to leverage large-scale electronic health records (EHR) to support robust, clinically meaningful disease diagnosis and prognosis. Real-world EHR data are inherently irregular, heterogeneous, and incomplete, yet they encode rich temporal dynamics of patient health; my work develops foundation modeling techniques that natively handle such irregular clinical time series without ad-hoc preprocessing, enabling models to learn universal representations and support zero-shot generalization across clinical settings and tasks.

Beyond structured EHR signals, effective diagnosis in practice requires integrating complementary modalities such as clinical notes, medical imaging, and physiological audio, which provide semantic context, anatomical detail, and functional cues that structured data alone cannot capture. I explore multimodal frameworks that align and fuse heterogeneous clinical modalities within unified models and agent systems, enabling richer and more reliable diagnostic reasoning that mirrors how clinicians synthesize diverse sources of evidence.

By combining robust temporal representation learning with multimodal fusion and scalable foundation modeling, my research aims to pave the way toward comprehensive diagnostic AI systems that support clinicians across diverse healthcare workflows, improve patient outcomes, and accelerate safe deployment of AI in real-world medical environments.

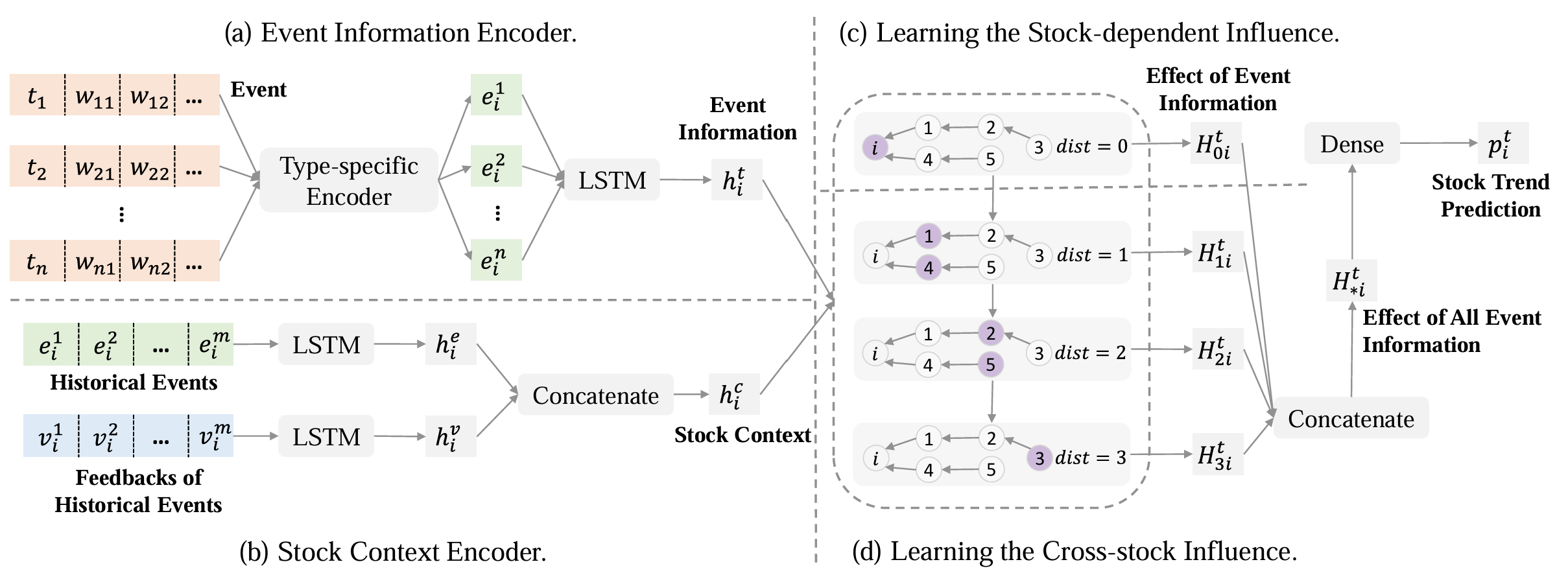

AI in Finance

One of my core research areas is AI in finance, specifically in stock market modeling. The stock market presents a rich and challenging environment for machine learning, characterized by dynamic, high-dimensional, and sequential data. Modeling financial markets requires sophisticated techniques to capture temporal dependencies and fluctuations, which I address using sequential models such as Recurrent Neural Networks (RNNs), Long Short-Term Memory (LSTM) networks, and Transformers.

In the context of financial data, two primary types of time-series data are crucial:

- Price-Volume Data: This is coarse-grained data that captures overall market trends, including price movements and trading volumes. Predictive models built on this data are focused on identifying broader market trends and forecasting stock price fluctuations.

- Order Book Data: This is fine-grained data representing real-time order book dynamics, detailing the bid-ask spreads, order flows, and market depth at different price levels. Models that process order book data require a higher level of granularity and are particularly useful for analyzing market microstructure and short-term price movements.

In addition to time-series data, I also explore the integration of textual data such as financial news, reports, and social media sentiment. These data sources help uncover critical events and reveal the relationships between stocks, offering a richer context and more comprehensive predictions for market behavior. By incorporating these heterogeneous data sources, I aim to enhance the predictive power and robustness of financial models.

The primary tasks of my research in finance focus on:

- Prediction: Developing robust models that forecast stock price trends, market volatility, and financial risk based on historical and real-time data.

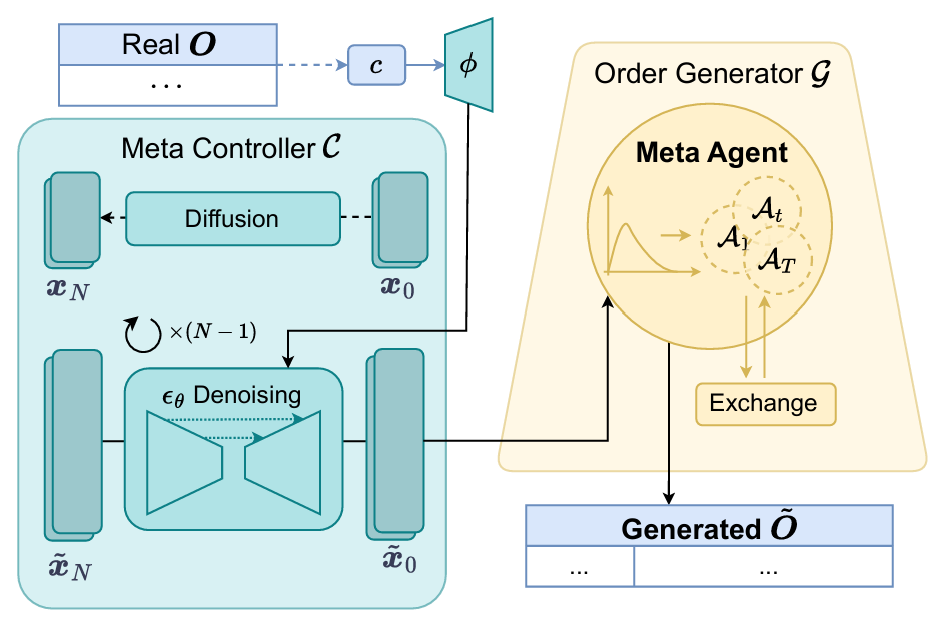

- Generation: Building generative models that simulate realistic financial scenarios, improving market simulations and decision-making in uncertain environments.

Through these efforts, my research seeks to bridge the gap between AI techniques and real-world financial applications, improving both predictive accuracy and model interpretability.

Research Works

Publications ( show selected / show all by date / show all by topic )

Topics: AI in Healthcare / AI in Finance / Time-series Analysis / Generative Modeling / Sequential Modeling (* indicates equal contribution)

Controllable financial market generation with diffusion guided meta agent

Yu-Hao Huang, Chang Xu, Yang Liu, Weiqing Liu, Wu-Jun Li, Jiang Bian

MIRA: Medical Time Series Foundation Model for Real-World Health Data

Hao Li, Bowen Deng, Chang Xu, Hao Li, Zhiyuan Feng, Viktor Schlegel, Yu-Hao Huang, Yizheng Sun, Jingyuan Sun, Kailai Yang, Yiyao Yu, Jiang Bian

TarDiff: Target-Oriented Diffusion Guidance for Synthetic Electronic Health Record Time Series Generation

Bowen Deng, Chang Xu, Hao Li, Yu-Hao Huang, Min Hou, Jiang Bian

BRIDGE: Bootstrapping Text to Control Time-Series Generation via Multi-Agent Iterative Optimization and Diffusion Modelling

Hao Li, Yu-Hao Huang, Chang Xu, Viktor Schlegel, Renhe Jiang, Riza Batista-Navarro , Goran Nenadic, Jiang Bian

TimeDP: Learning to Generate Multi-Domain Time Series with Domain Prompts

Yu-Hao Huang, Chang Xu, Yueying Wu, Wu-Jun Li, Jiang Bian

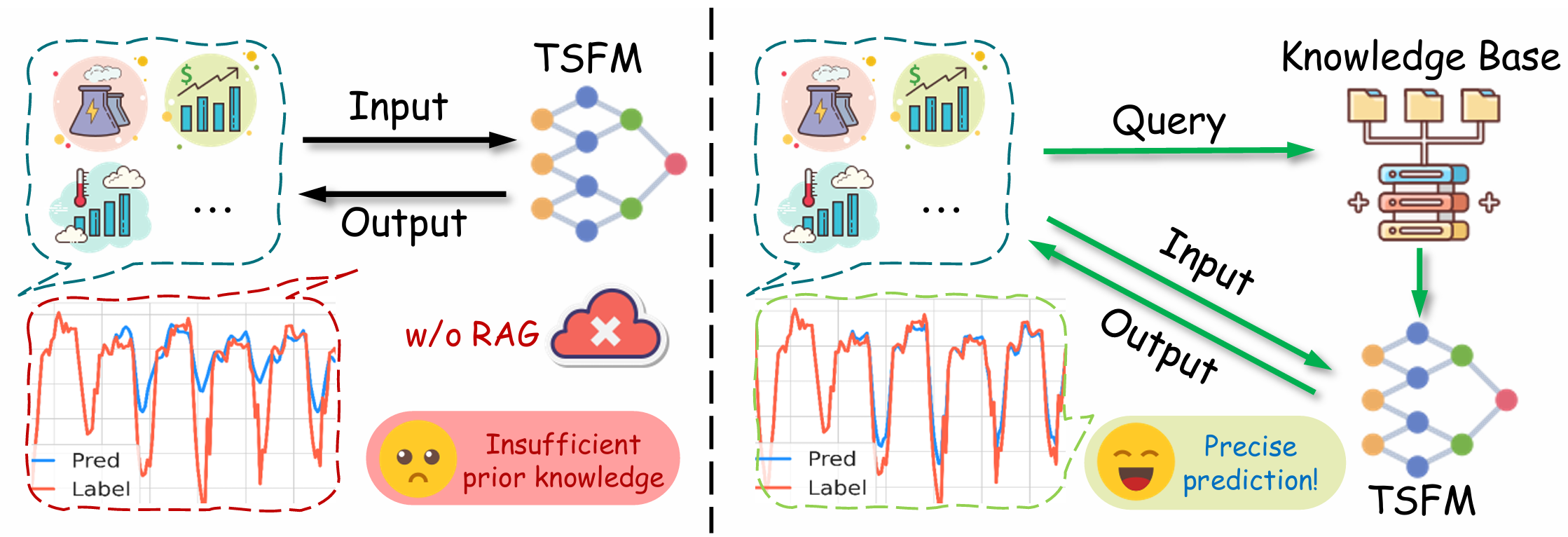

TimeRAF: Retrieval-Augmented Foundation model for Zero-shot Time Series Forecasting

Huanyu Zhang, Chang Xu, Yi-Fan Zhang, Zhang Zhang, Liang Wang, Jiang Bian, Tieniu Tan

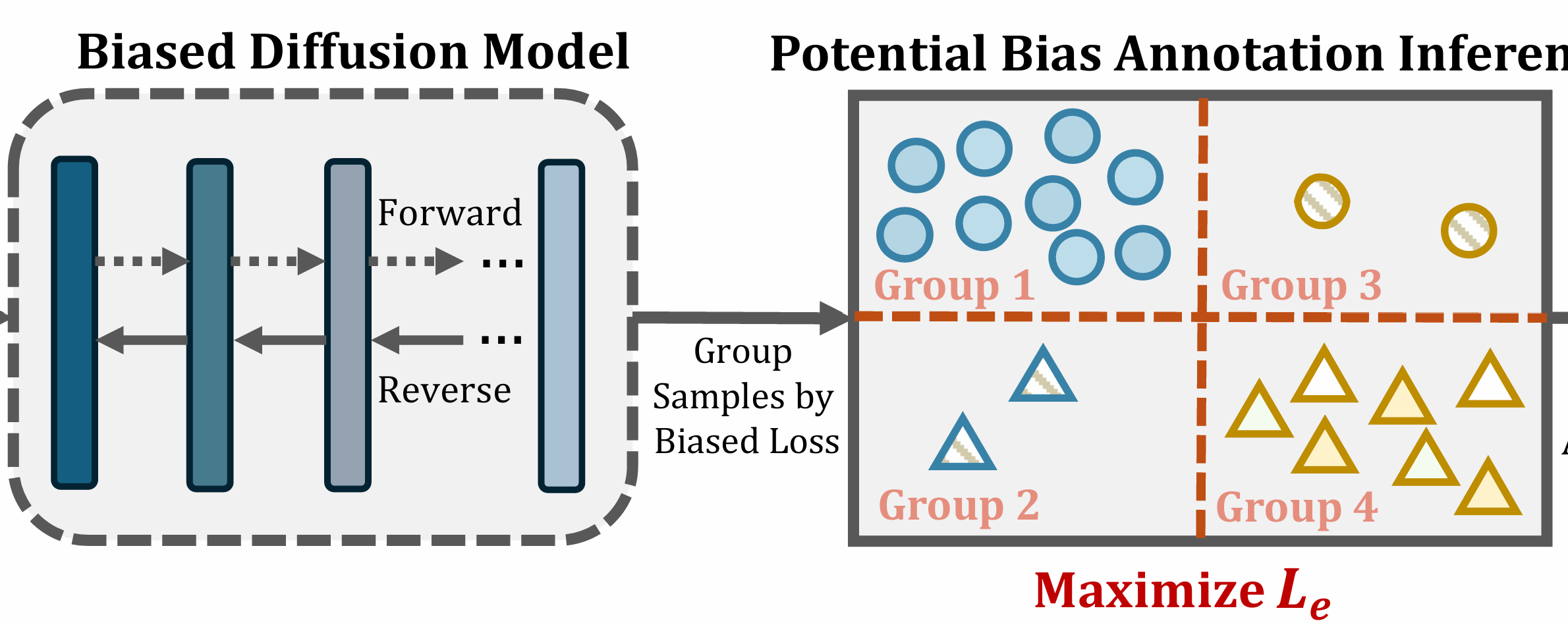

InvDiff: Invariant Guidance for Bias Mitigation in Diffusion Models

Min Hou*, Yueying Wu*, Chang Xu, Yu-Hao Huang, Xibai Chen, Le Wu, Jiang Bian

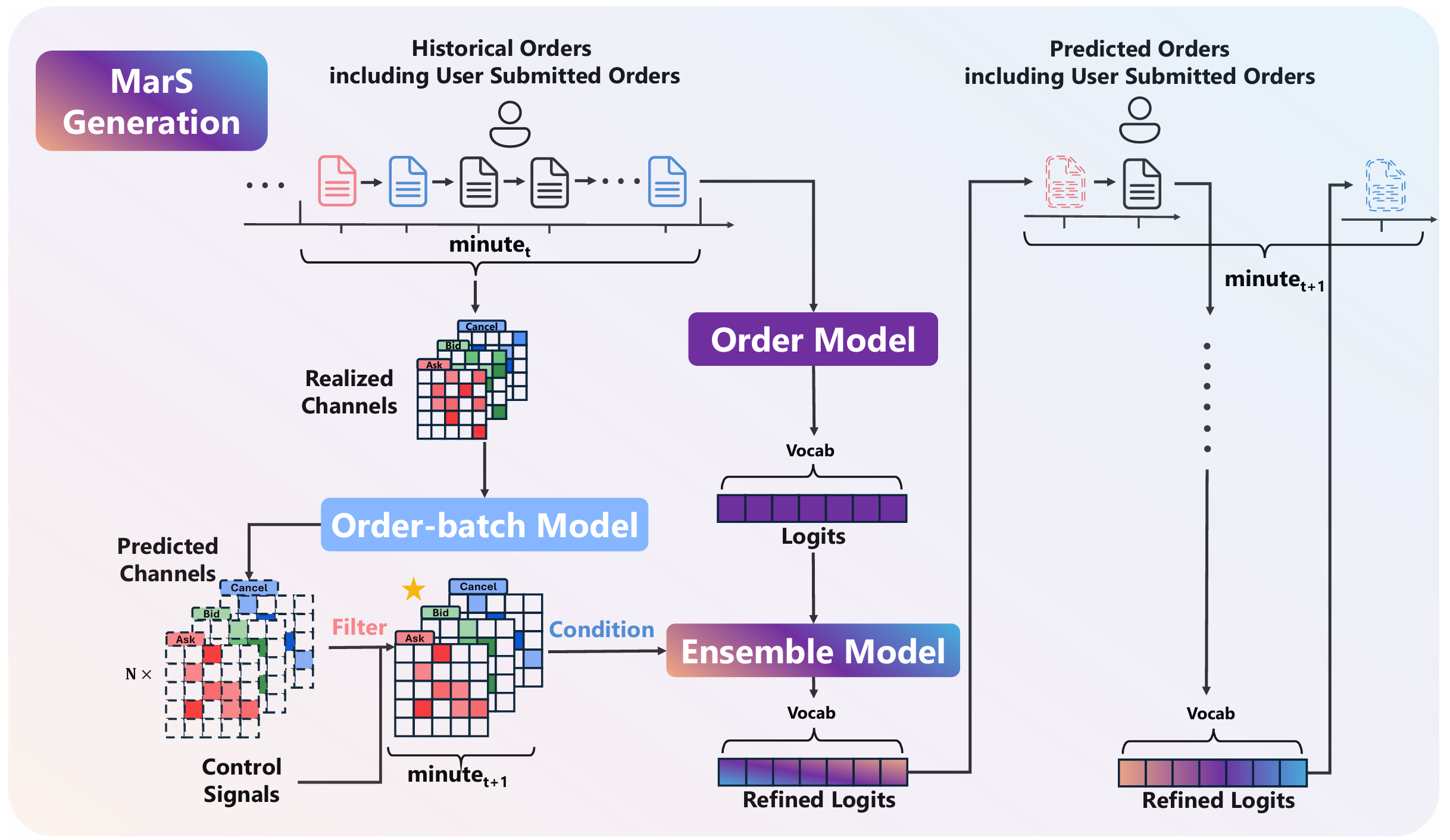

MarS: a Financial Market Simulation Engine Powered by Generative Foundation Model

Junjie Li, Yang Liu, Weiqing Liu, Shikai Fang, Lewen Wang, Chang Xu, Jiang Bian

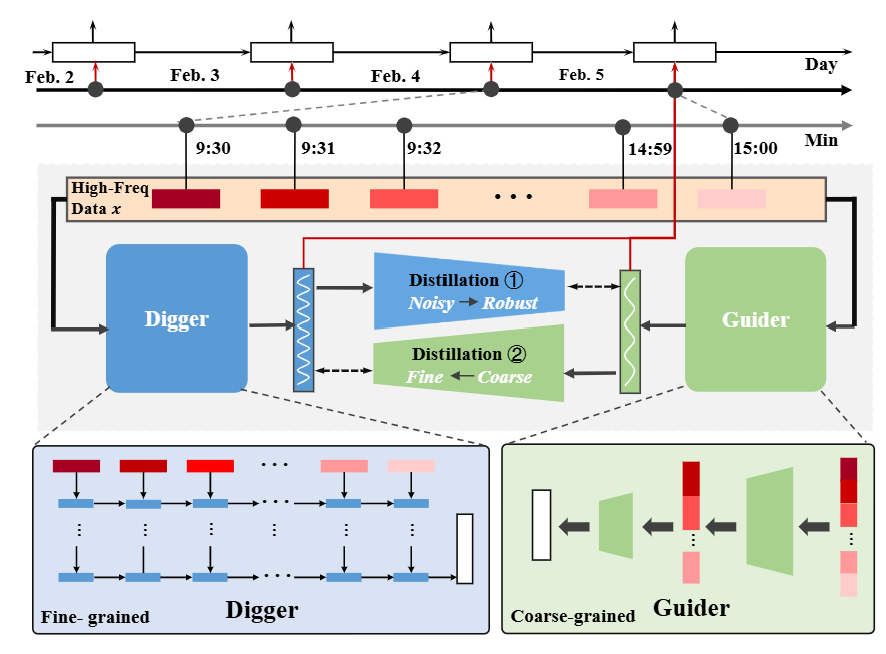

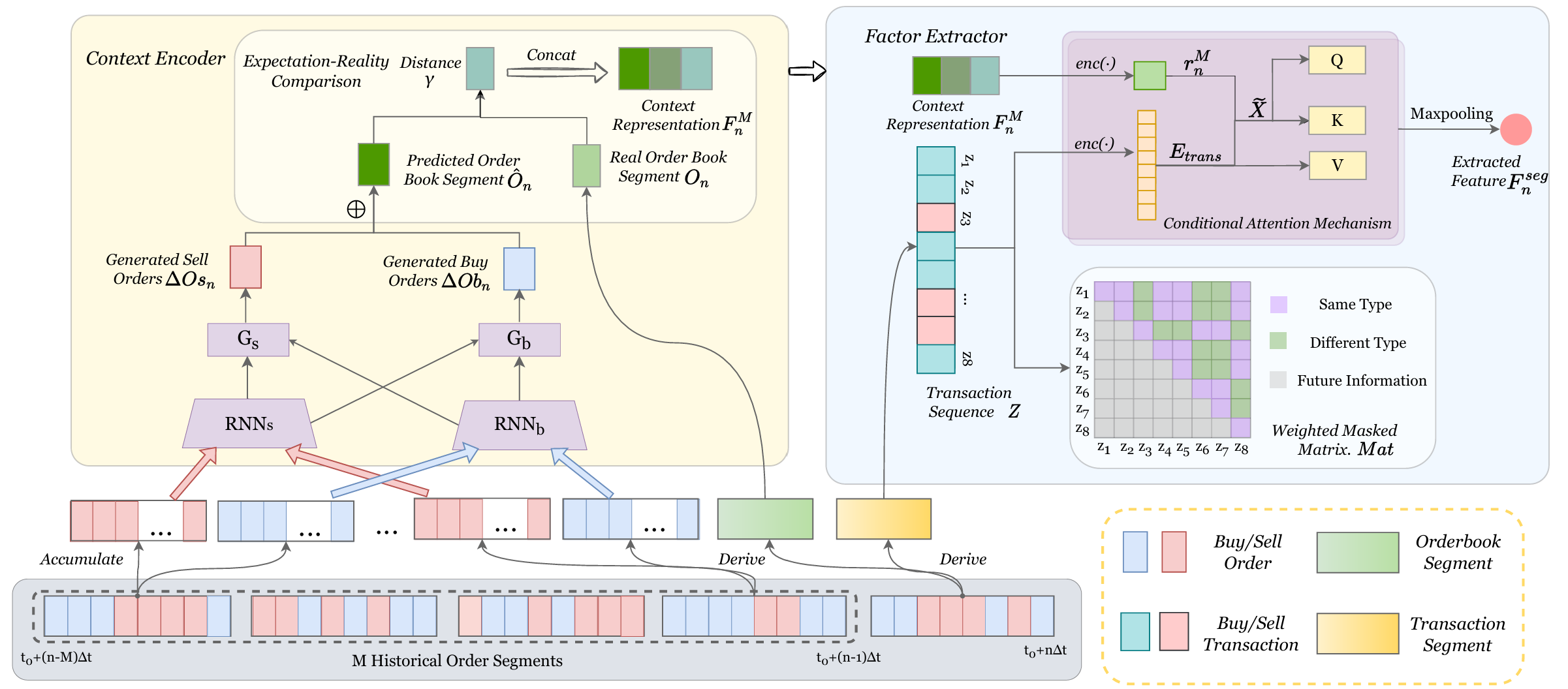

Digger-Guider: High-Frequency Factor Extraction for Stock Trend Prediction

Yang Liu, Chang Xu, Min Hou, Weiqing Liu, Jiang Bian, Qi Liu, Tie-Yan Liu

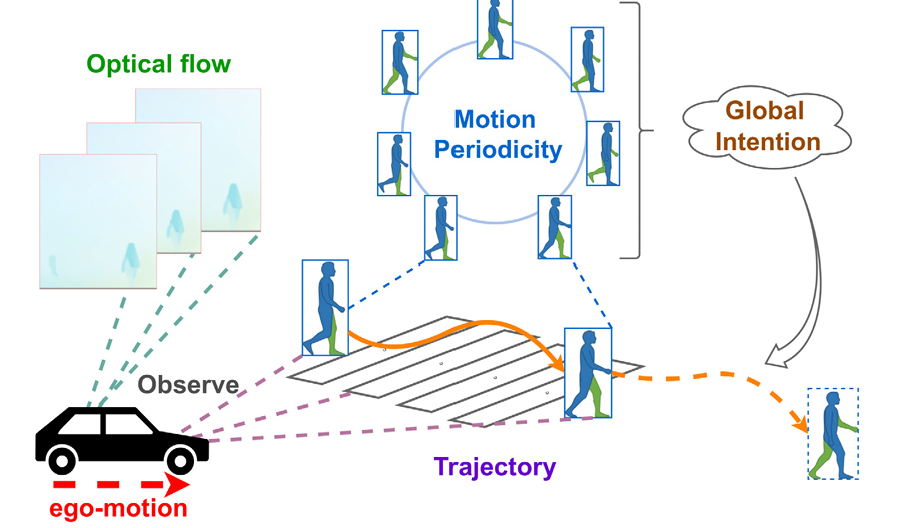

A multimodal stepwise-coordinating framework for pedestrian trajectory prediction

Yijun Wang, Zekun Guo, Chang Xu, Jianxin Lin

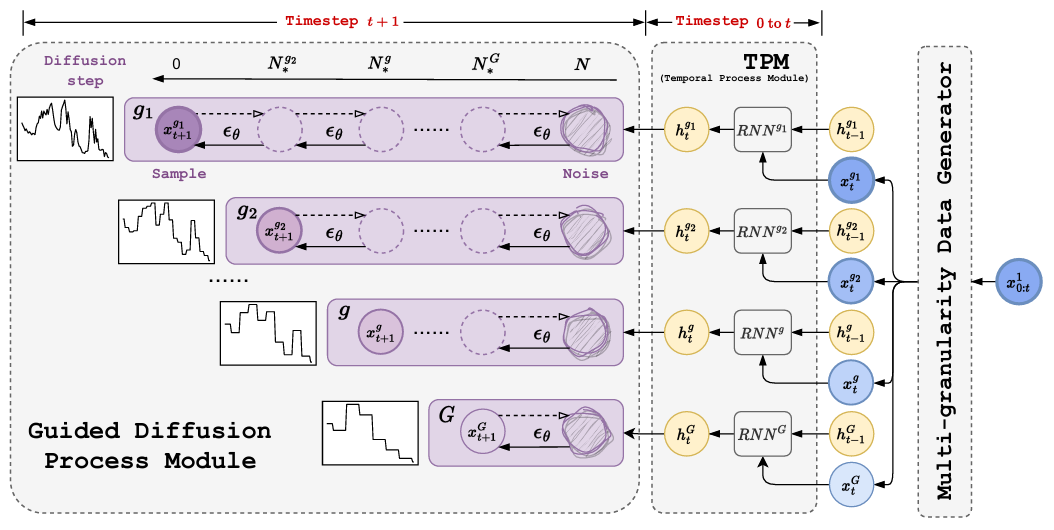

MG-TSD: Multi-granularity time series diffusion models with guided learning process

Xinyao Fan, Yueying Wu, Chang Xu, Yuhao Huang, Weiqing Liu, Jiang Bian

Microstructure-Empowered Stock Factor Extraction and Utilization

Xianfeng Jiao, Zizhong Li, Chang Xu, Yang Liu, Weiqing Liu, Jiang Bian

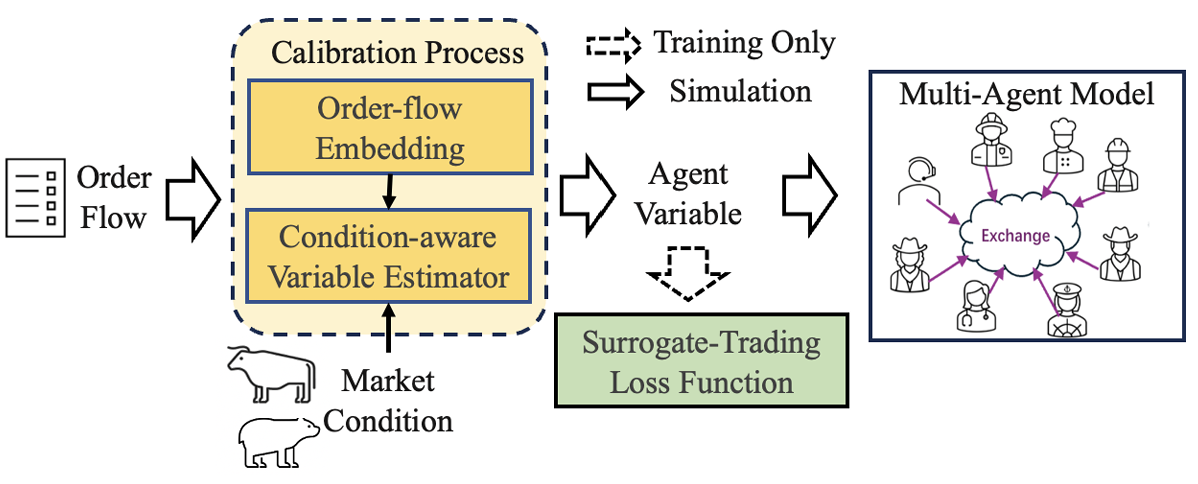

Efficient Behavior-consistent Calibration for Multi-agent Market Simulation

Tianlang He, Keyan Lu, Chang Xu, Yang Liu, Weiqing Liu, S-H Gary Chan, Jiang Bian

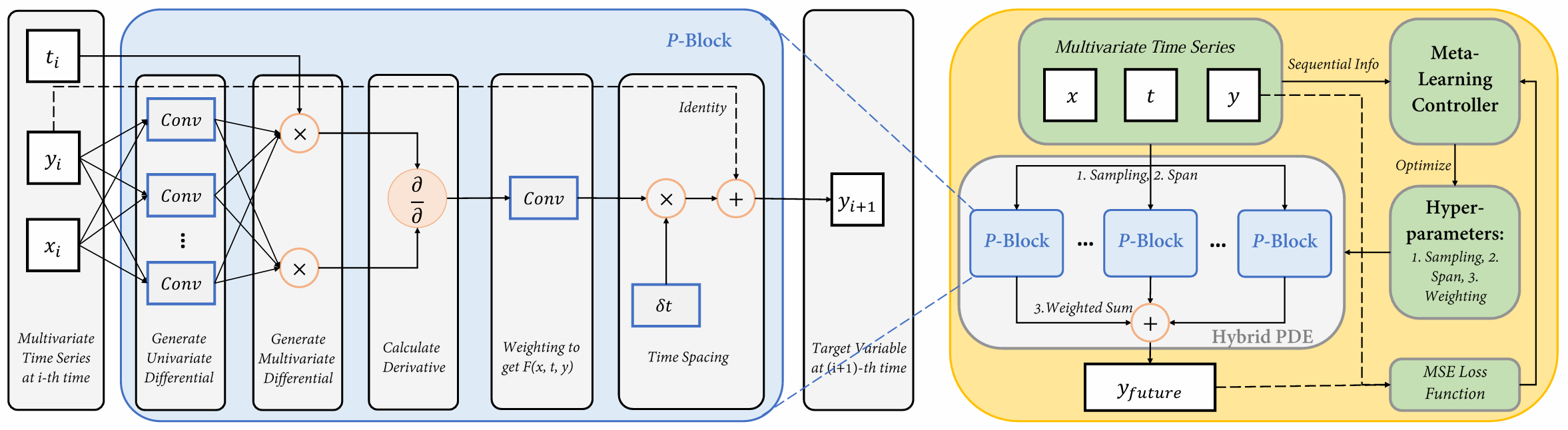

Learning differential operators for interpretable time series modeling

Yingtao Luo, Chang Xu, Yang Liu, Weiqing Liu, Shun Zheng, Jiang Bian

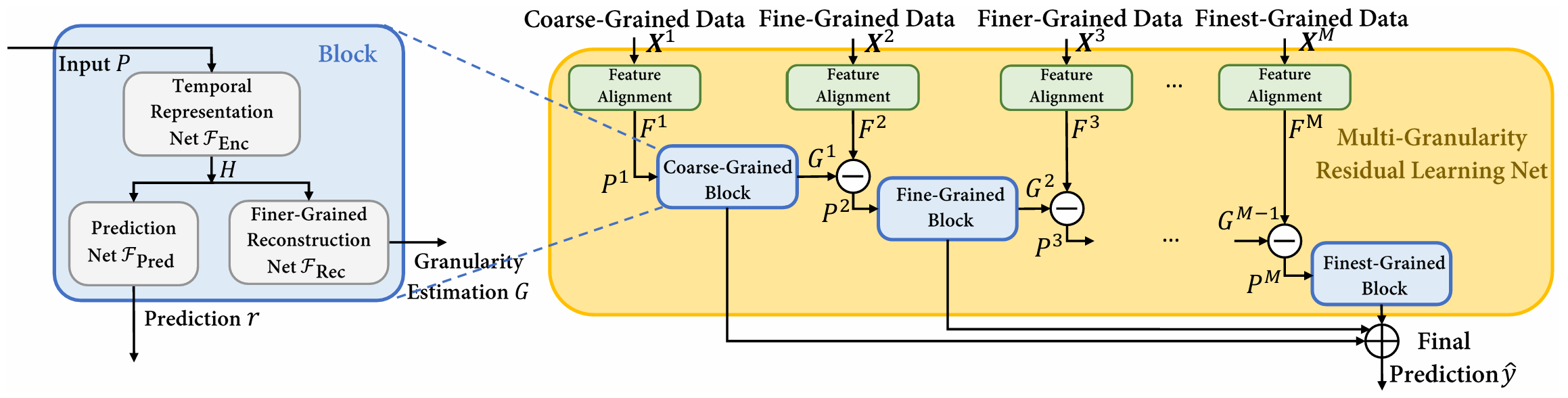

Multi-granularity residual learning with confidence estimation for time series prediction

Min Hou, Chang Xu, Zhi Li, Yang Liu, Weiqing Liu, Enhong Chen, Jiang Bian

Stock trend prediction with multi-granularity data: A contrastive learning approach with adaptive fusion

Min Hou, Chang Xu, Yang Liu, Weiqing Liu, Jiang Bian, Le Wu, Zhi Li, Enhong Chen, Tie-Yan Liu